My work: Analysts unmoved by China’s latest shale gas auction delay

Posted: September 2nd, 2012 | Tags: auction, China, delay, energy, natural gas, shale gas, tender | No Comments »

The story after the jump was written by me and James Byrne for Interfax Natural Gas Daily, a digital publication that reports on the global gas industry. The story was published on 21 August 2012 (subscribers only) and looks at the setbacks to China’s latest auction of rights to prospect for shale gas, which is a form of natural gas found in shale rock deep underground.

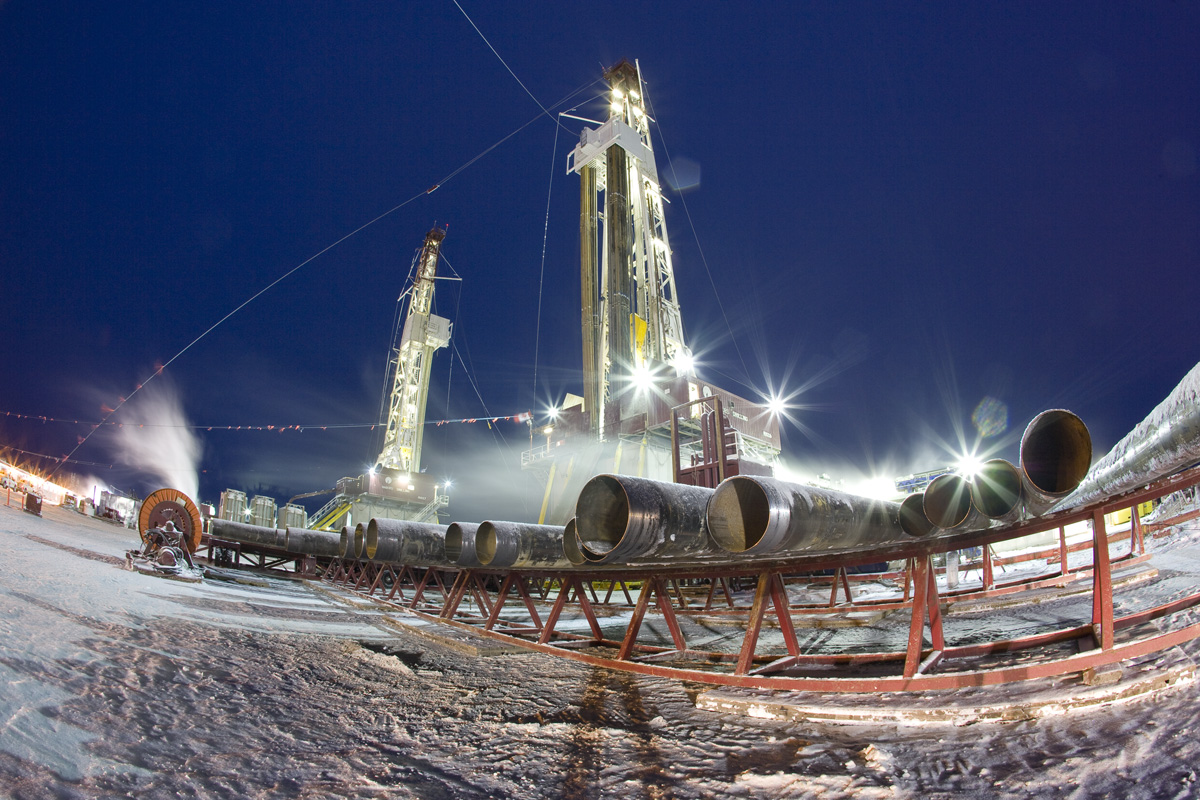

China is believed to have the largest recoverable reserves of shale gas worldwide, enough to last nearly 200 years at the country’s rate of gas consumption in 2011, but the method of extracting shale gas – hydraulic fracturing or ‘fracking’ – is environmentally contentious.

Analysts unmoved by China’s latest shale gas auction delay

Confirmation last week that China will delay its second tender for shale gas blocks came as no surprise to analysts, who expect further holdups as Beijing attempts to draft a viable strategy for tapping its vaunted shale resources.

In the latest setback, China’s Ministry of Land and Resources (MLR) confirmed to Interfax last week it would delay the licensing round until September.

“This auction has been delayed repeatedly, and progress was already undoubtedly slow,” Simon Powell, CLSA’s head of oil and gas for Asia, told Interfax.

“In the past 10 years, the United States has drilled tens of thousands of wells; China has drilled around 80 in the past two. Don’t expect anything spectacular before 2015,” Powell added.

The repeated delays have caused others to questions the MLR’s amended September timetable. “After many postponements, I will not be surprised if further delays happen,” said Huang Xinhua, a Singapore-based analyst with energy consultancy IHS.

The root of the delays is “not an easy issue to be solved properly in a short time period as it covers many aspects,” Huang said, adding that he “doesn’t expect much” from the auction.

The second tender is scheduled to take place 15 months after the first, which saw two of four blocks successfully auctioned to state-owned Chinese companies. While various media reports and government announcements have since reported the second auction as being imminent, it has not materialised.

Enthusiasm on the part of Chinese and foreign investors has been building over the second tender, which will open up bidding to private domestic firms.

‘Complicated issues’

While the MLR did not provide a reason for the latest delay, analysts say a number of problems are holding up the second licensing round. Among the most prominent are the MLR’s lack of experience drafting qualification criteria and its juggling of competing government interests.

“It is a very complicated issue… no experience, too many stakeholders involved, too ambitious targets, and time pressure from the top,” said Huang.

Differences between ambitious government targets and more conservative forecasts by China’s state-owned energy companies may have also contributed to the hold-up, said Powell.

Another principal problem has been a lack of good geological data for the potential blocks on offer. “The blocks to be auctioned are more peripheral ones, and they’re not as prospective. Little seismic work has been done on them,” a Hong Kong-based analyst, who did not wish to be named, told Interfax.

Li Yuxi, an official from the MLR, said last week that blocks in 10 administrative areas – municipalities, provinces, and autonomous regions – would be on offer in September. The blocks, however, are likely to lie outside acreage already owned by PetroChina and Sinopec.

“Frankly speaking, the blocks in the auction are less attractive than many acreages currently held by the national oil companies,” said Huang. “Having said that, it is possible some good blocks exist which we don’t know [about] because we don’t have data.”

The absence of reliable data and the unappealing nature of the blocks appears to have soured interest among some investors.

“The likely issue [for the delays] is the lack of data and understanding of the potential assets,” the Hong Kong-based head of Asia-Pacific oil and gas for a multinational bank told Interfax, on the condition of anonymity. This means that “for anyone to come in and make a commitment, the terms have to be very lenient – in terms of spending beyond seismic for example”, he said.

With some questions remaining about the nature of the assets to be put under the hammer, and the sizeable up-front capital that will be required to exploit discovered shale deposits, it is perhaps unsurprising that interest in the much-delayed tender is waning.

The cost of drilling for shale gas in China is considerably higher than in the US, where an established industry and well-developed service sector has brought costs down. Difficult geology and deeper shales also make exploration more expensive and results more uncertain.

Developing a flexible regulatory framework that balances the interests of risk-adverse investors and local governments keen on shale gas to boost the local economy “may take time as locals probably want as much as possible in terms of commitments while [the central government] may understand better that this may not work”, the Hong Kong banker said.

Political considerations

A politically charged leadership change set to begin in autumn may also be distracting officials tasked with mapping out China’s shale gas development. The Communist Party’s hopes of a smooth transition were dashed in March, when Bo Xilai was ousted as the high-flying party chief of Chongqing municipality in connection with the death of British businessman Neil Heywood. Chongqing is one of China’s most promising shale gas development areas.

“Given the leadership transition, you should expect delays with the auction,” said the Hong Kong-based analyst.

Future impact

Analysts are divided on whether the latest setback would undermine China’s shale gas prospects. “I don’t think the delay will have a significant slowdown on the country’s shale gas development programme,” said Huang, noting that several projects independent of the auction are underway by China’s three energy giants. The companies can also count on plenty of acreage for further exploration and development.

“The issue is whether China’s short- and long-term production targets are practical and deliverable,” Huang said.

“I don’t think this delay bodes well for China’s shale industry,” said Chris Faulkner, chief executive of Breitling Oil and Gas, an American unconventionals player which is shooting seismic on some of China’s shales. “They can’t even seem to perform an auction, which goes to show how immature the industry is in China,” he told Interfax.

The Hong Kong banker was also pessimistic. “I am somewhat sceptical of the whole shale thing in China, not that I don’t think it is there, but I think first mover advantage may actually be a disadvantage, as the learning curve starts very high up with the lack of data and [lack of] likely equipment of adequate quality and quantity, along with the well-known water resources issue,” he said.

Leave a Reply